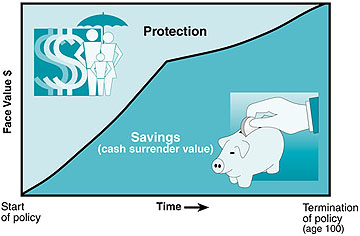

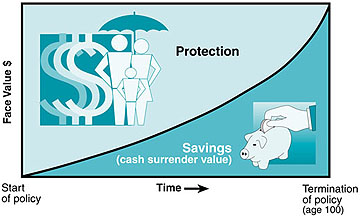

straight life policy develops cash value

Web Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. Straight life policy develops cash value Friday June 10 2022 Edit.

How Innovative Companies Train Their Employees

Which of the statements is not true regarding a Straight Life policy.

. It usually develops cash value by the end of the third policy year It has the lowest annual premium of the three types of Whole. Get an instant estimate. Usually develops cash value by end of third policy year C.

Cash value builds up in your permanent life insurance policy when your premiums are split up. The face value of the policy is paid to the insured at age 100. Which statement is NOT true regarding a Straight Life policy.

A straight life insurance policy often known as whole life insurance. A straight life insurance policy provides lifelong coverage at a consistent premium rate. Ad Find out what your policy is worth.

Maximize your cash settlement. The face value of the policy is paid to the. It usually develops cash value by the end of.

A It has the lowest annual premium of the three types of Whole Life policies. Premium steadily decreases over time in response to its growing cash value. Easy Online Application with No Medical Exam Required Just Health and Other Information.

If a life insurance policy develops cash value faster than a seven-pay whole life contract it is 1. - face value is paid to insured at 100 - it. Taxation of Life Insurance and Annuities Premiums.

The Most Reliable Life Insurance Companies That Will Actually Cover Your Loved Ones. All policy types qualify. - face value is paid to insured at 100 - it develops cash value by the end of the third policy year - it has the lowest annual.

The face value of the policy is paid to the insured at age. See Your Rate and Apply Online. Plr He May 21 2022 Edit.

Get the info you need. Which statement is NOT true regarding a Straight Life policy. The premium for a straight life policy is fixed and does not increase with age.

It covers your life for a chosen period of time during which only the death of the insured will pay. Straight life policy develops cash value. Usually develops cash value by end of third policy year C.

It usually develops cash value by the end of the third policy yearC. Ad Valuable Term Coverage from 10000 to 150000. Which statement is NOT true regarding a Straight Life Policy.

A straight life policy has a level premiumit wont change over the life of your policy. Ad Get Instantly Matched with Your Ideal Life Insurance Plan. Get the info you need.

We show you how. The face value of the policy is paid to. What is Straight Life Insurance.

This is a straight life annuity that starts paying you back as. A straight life insurance policy provides lifelong. B Its premium steadily decreases over time in response to its growing cash value.

Life Insurance Flashcards Quizlet

What Is Straight Life Insurance Valuepenguin

Life Insurance Purposes And Basic Policies Mu Extension

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_Straddle_Strategy_For_Market_Profits_Jun_2020-02-4f0d46de5d5e4635a47a80a752626d6e.jpg)

Understanding A Straddle Strategy For Market Profits

Converting A Term Life Insurance Policy To Whole Life Insurance Bankrate Com

Life Insurance Flashcards Quizlet

Life Insurance Flashcards Quizlet

Barrick Gold Corporation Investors Annual Meeting Information Circular Schedules

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Flashcards Quizlet

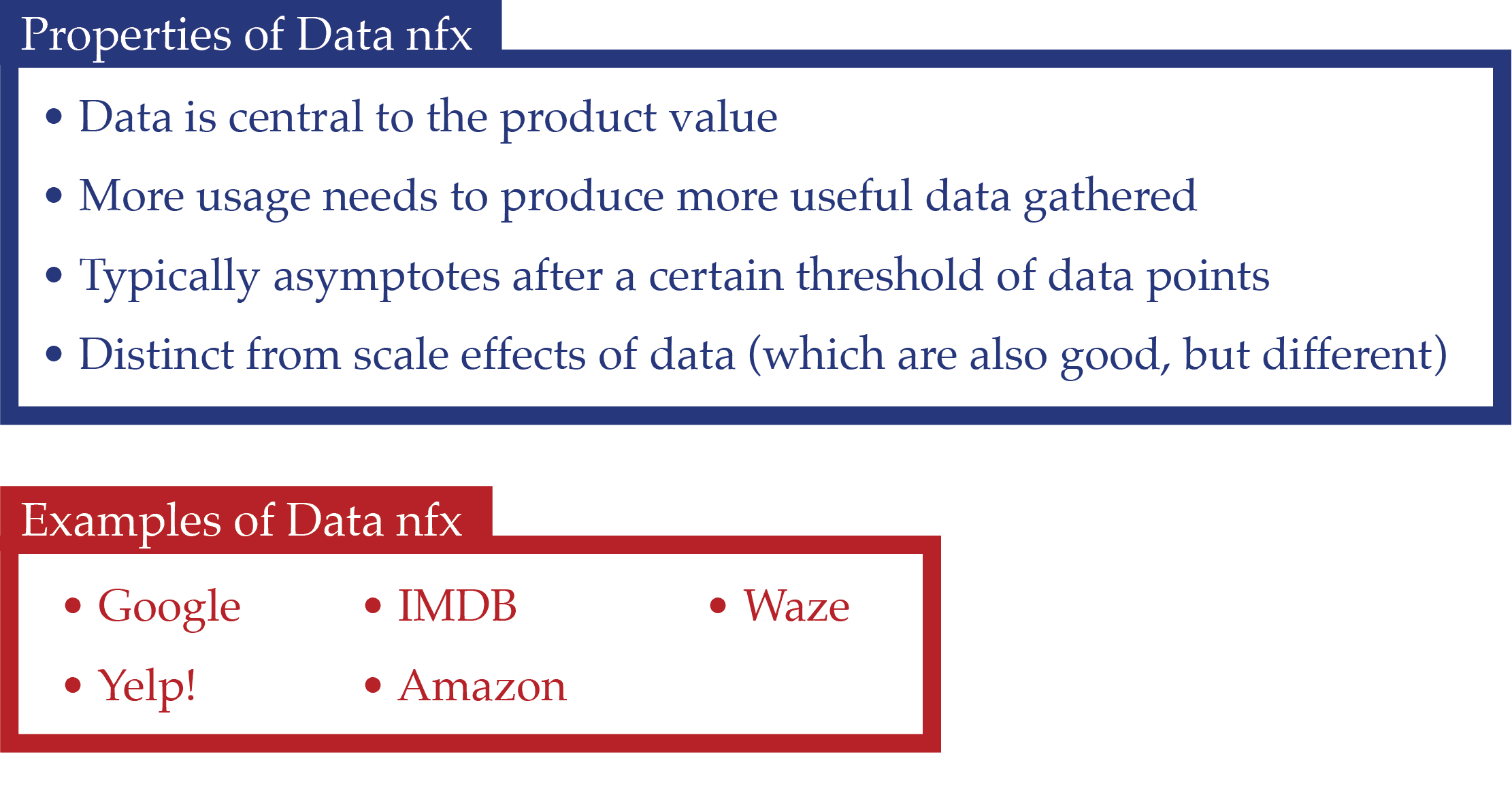

The Network Effects Manual 16 Different Network Effects And Counting

Coinbase Ipo Here S What You Need To Know Forbes Advisor

We Re Pregnant The First Time Dad S Pregnancy Handbook Kulp Adrian 9781939754684 Books Amazon Ca